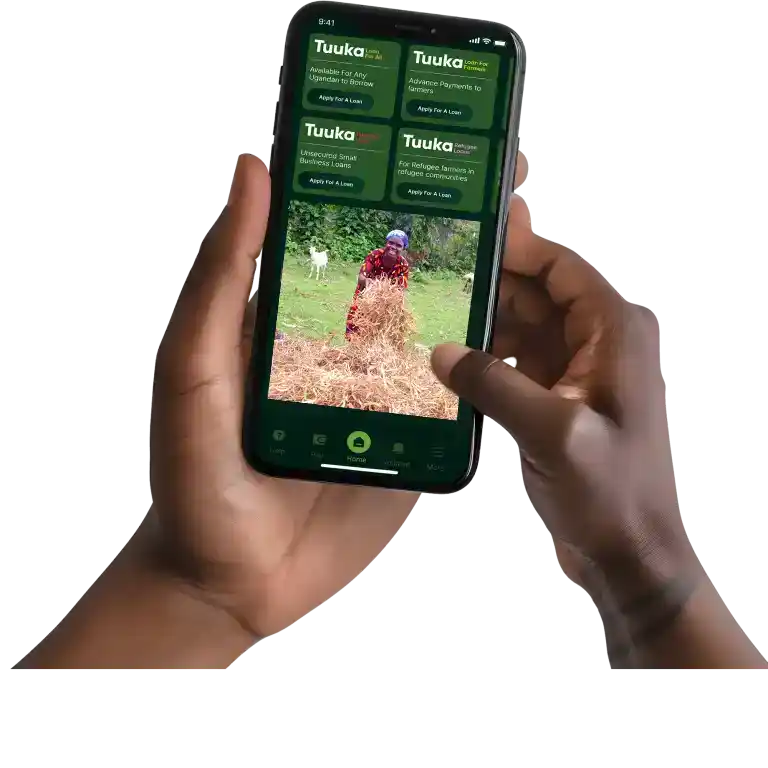

Tuuka is dedicated to empowering the unbanked, with a specific focus on village farmer groups, village savings groups, and refugee communities. Unlike traditional banks, Tuuka utilizes alternative data to build a creditworthiness score based on members’ borrowing and repayment histories.

Inclusive Finance

The Solution

No Collateral -

Bigger Loans

Tuuka utilizes alternative data to build a creditworthiness score based on members’ borrowing and repayment histories. This score ranges from 0 to 100%, gradually increasing as users repay loans successfully. Upon reaching a 100% score through consistent repayments, users become eligible for larger financing opportunities, creating a valuable financial identity without the need for traditional collateral. Our customers can access loans of up to UGX 5,000,000 without the traditional collateral typically required by other financial institutions.

Our

Approach

We address the funding gap left by conventional banks through our inclusive design and approach to financial empowerment. Our Loans start at $30 with flexible repayment options in cash or produce, which we process into flour and animal feed. This creates both market access for farmers and a dual revenue stream for Tuuka.

Apply for an inclusive loan

Our

Trusted Community Agents

Our community agents are the first link in Tuuka’s lending chain. This local trust network reduces risk, ensures fairness, and helps Tuuka serve communities that banks overlook. We don’t use faceless systems to decide who deserves a loan. Our agents are trusted neighbors who know each customer’s story, family, and farm. They ensure loans go to those who will use them wisely, protecting both the community and Tuuka. This personal trust replaces collateral and creates dignity in borrowing.

A Tuuka loan doesn’t come with pressure calls from a city office. Instead, our community agents check in on customers at the farm, at the market stall, or at home. They offer encouragement, reminders, and support to keep repayments on track. That’s why customers not only repay but they’re eager to reapply.

Credit Begins with Character

At Tuuka.co, we believe that true credit is built on character. We respect our grassroots entrepreneurs and MSMEs who are transforming hard-to-reach communities with honesty, resilience, and commitment.

Ethical behavior is a shared responsibility between our entrepreneurs, community agents, and us as a financial partner. By upholding transparency, fairness, and accountability, we create a system rooted in integrity and dignity, where ethical behavior itself becomes credit.

That’s why Tuuka.co allows customers to defer seasonal or emergency loan repayments up to three times, paying only the interest because we understand that trust grows stronger when we stand with our clients through both good and challenging seasons.

Most financial institutions expect clients to already understand complex systems, balance sheets, credit reports, savings accounts. But in many Ugandan villages, these tools have never been explained. Tuuka takes a different path. Through our trusted agents, we bring financial literacy right to the customer’s doorstep. Farmers learn how to keep simple records of sales, expenses, and profits. Mothers running small shops learn the importance of separating business money from household money. Youth are taught how to save consistently, even in small amounts, so they can invest in their future. Over time, these lessons build habits of discipline and planning. With every repayment, customers are not just clearing a loan, they are creating their first financial history. For the unbanked, this is life changing. It means stepping out of invisibility and gaining access to future opportunities, bigger loans, input financing, and eventually the broader financial system.

Access to money alone doesn’t guarantee success. A farmer with poor soil, weak harvests, or outdated methods will remain stuck in the same struggles, even with a loan. Tuuka solves this by combining credit with knowledge. Our agents organize trainings on permaculture and regenerative farming, demonstrating how to enrich soils, diversify crops, and reduce dependence on expensive chemical inputs. Families learn how to manage pests naturally, conserve water, and rotate crops for healthier yields. By aligning financial capital with farming knowledge, we make sure that a $30 loan becomes seed for transformation literally and figuratively. Better farming practices mean higher yields, which translate into food security at home and surplus for the market. This ensures that repayments are manageable, while families gain confidence that they can sustain themselves beyond a single harvest. It’s not just about giving money; it’s about building long-term resilience for generations.

One of the greatest failures of traditional banking is that wealth flows out of villages. Interest payments, fees, and profits are extracted to distant urban centers or even overseas, leaving rural families poorer in the long run. Tuuka flips this model. Our agents oversee flexible repayment systems that allow customers to repay not only in cash but also in produce maize, soya, millet, rice, groundnuts, and beans. Instead of draining value, Tuuka processes this produce into flour and animal feed. This creates guaranteed markets for farmers, stable supply for local food systems, and an additional revenue stream that sustains Tuuka itself. By closing this loop, money and value circulate within the community. Farmers get fair prices, Tuuka earns stability, and families see wealth reinvested into their own villages rather than extracted away. It is a circular economy model designed not to strip communities of resources, but to strengthen them from the inside out.

In rural Uganda, most people have never held a bank card, never logged into an online account, and never seen their name on an official financial record. Without this digital footprint, they remain invisible to the formal economy considered “too risky” by banks. Tuuka changes this through simple, accessible tools. Using USSD codes that work even on basic feature phones, our agents help customers register, receive loan details, track repayments, and confirm produce deliveries. Each transaction becomes a building block of a verifiable financial record. Over time, this creates something priceless: a digital credit history for people who were once excluded. For the borrower, it means dignity and recognition. For the investor, it means transparency and reduced risk. For the community, it means no one is left behind as Uganda’s economy digitizes. Tuuka’s approach ensures that the unbanked finally get their first digital key to the wider financial system.

Why Our Purpose

Stories

Most financial institutions measure success in balance sheets. At Tuuka, we measure it in lives changed. Numbers matter but behind every repayment percentage is a farmer putting children through school, a shopkeeper expanding her business, or a youth saving for the first time. We tell stories because they remind us and our partners that financial inclusion is about dignity, resilience, and hope. Stories carry voices that have too often been ignored. And when those voices are heard, entire communities rise.

At Tuuka, we believe that true wealth starts with healthy soil. That’s why our training goes beyond money to include permaculture a way of farming that restores fertility, conserves water, and makes small plots more productive. For rural families, this means bigger harvests, lower costs, and food security all year round. For the planet, it means farming that heals instead of harms. By blending financial access with permaculture skills, we ensure that every loan doesn’t just grow a business but it grows healthier communities and a healthier environment.

Big banks look at rural borrowers and see “high risk.” We see resilience, wisdom, and untapped potential. Grassroot communities already have trust networks, leaders, and informal systems that have sustained them for generations. Tuuka builds on that foundation instead of imposing outside rules. By working through trusted agents like “Mama J,” we give communities control over their own development. This grassroots-first approach ensures that financial inclusion isn’t charity or dependency, it’s empowerment that grows from within.

Loans without knowledge can lead to short-term gains but long-term struggles. That’s why Tuuka combines credit with regenerative farming training. We help farmers replace costly chemical inputs with natural methods that rebuild the land. Regenerative farming improves yields, protects water sources, and strengthens resilience to climate change. For women and youth farmers, it’s the difference between surviving from season to season and thriving for the future. Our stories are not just about repayments, they are about restoring dignity to farming and making it profitable again.

Trust is the most valuable currency in rural Uganda. That’s why Tuuka doesn’t operate from distant offices but through local agents who already have the respect of their neighbors. These agents know who is ready for a loan, who needs extra guidance, and who can grow with the right support. By working through them, we replace collateral with trust, bureaucracy with relationships, and risk with accountability. Community agents make financial services feel human, dignified, and accessible and they ensure that success stays rooted in the village.

The Digital

“Village Bank”

Tuuka is your digital “Village Bank,” offering quick, secure, and inclusive financial services directly to your phone. We simplify access to loans and savings for unbanked communities, creating an ecosystem of trust and growth.

Loan Application

DISCLAIMER

Dear Applicant, completing the Tuuka Loan application form is entirely free of charge, with no registration fees required. This application is exclusively for those seeking Business Financing, and submitting the form does not guarantee approval. The information you provide will be used for an initial assessment, and we will communicate the next steps and requirements to determine your eligibility. All data submitted will remain confidential, even if your application is not successful. To ensure accurate evaluation, please provide complete and truthful details about yourself and your business, as we may use this information to verify or gather additional insights from external sources. Thank you for considering Tuuka for your business financing needs.